Are you curious about the buzz surrounding AGS Transact Technologies Ltd IPO GMP? This upcoming IPO has caught the attention of investors and market watchers alike, sparking a wave of excitement and speculation. But what exactly makes AGS Transact Technologies so special, and why is everyone talking about its grey market premium (GMP)? If you’re looking to understand the potential of this IPO and how the GMP could impact your investment decisions, you’ve come to the right place. Many investors wondering whether to subscribe or not, and what the AGS Transact Technologies share price might be once it hits the market. The company operates in the fast-growing fintech sector, offering innovative payment solutions that are reshaping the digital transaction landscape. Isn’t it amazing how technological advancements can create such lucrative opportunities? Whether you’re a seasoned investor or a newbie, knowing the latest updates on AGS Transact Technologies IPO GMP trends can give you an edge. Stay tuned as we dive deep into the factors driving this IPO’s popularity, explore expert predictions, and reveal how you can capitalize on this exciting market event. Don’t miss out on discovering the secrets behind the AGS Transact Technologies public issue success!

What Is AGS Transact Technologies Ltd IPO GMP? A Detailed Beginner’s Guide

AGS Transact Technologies Ltd IPO GMP: What’s All the Fuss About?

So, you heard about ags transact technologies ltd ipo gmp, and wondering what the heck is going on? Well, you’re not alone. The IPO market is buzzing, and this particular company got people talking like crazy. But honestly, not really sure why this matters so much, but hey, the stock market got its own drama, right?

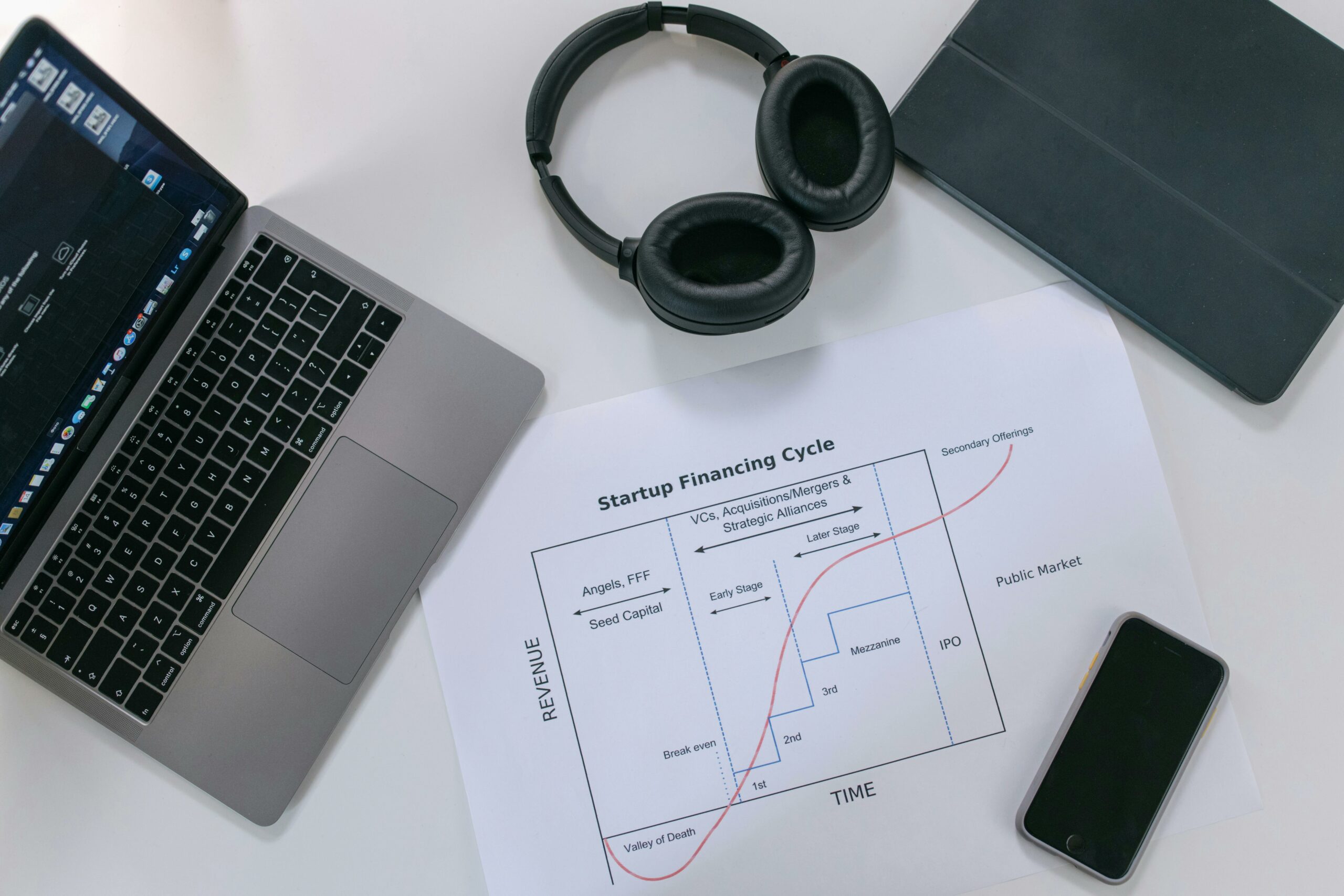

First off, let’s break down what GMP means. GMP stands for Grey Market Premium, which basically is the unofficial price where the IPO shares are trading before they actually list on the stock exchange. It’s kinda like a pre-party price tag, but nobody really knows if it’s gonna hold or crash. Sometimes the GMP is high, and everyone thinks the IPO gonna be a blockbuster; other times, it’s just hype with no real backing.

Here’s a quick table to make things clear, or at least less confusing:

| Term | Explanation |

|---|---|

| IPO | Initial Public Offering – when company goes public |

| GMP | Grey Market Premium – unofficial trading price |

| AGS Transact Tech Ltd | The company in question |

| Listing Date | The day shares officially start trading |

Now, talking about ags transact technologies ltd ipo gmp, the premium has been fluctuating like crazy. One day, it’s at ₹50, next day it’s ₹100, and sometimes you wonder if people just guessing. Maybe it’s just me, but I feel like these GMP numbers are like weather forecasts — sometimes right, often wrong.

Why people even care about GMP? Well, it gives a hint about the demand for the IPO. If GMP is high, it means investors are ready to pay extra to get in early, which often signals good listing gains. If low or negative, then… well, nobody’s lining up. But remember, GMP is not regulated, so no one really guarantee that it reflects the true value.

Let’s look at a simple pros and cons list regarding ags transact technologies ltd ipo gmp:

Pros:

- Gives an early indication of market sentiment

- Helps investors decide to apply or stay away

- Reflects hype or interest in the company

Cons:

- Unregulated and can be manipulated

- Not always accurate predictor of listing price

- Can mislead inexperienced investors

This IPO is from AGS Transact Technologies Ltd, a company known for offering digital payment solutions and services. They have a good track record, but again, the stock market is a wild beast, not a predictable puppy. The company’s financials look decent, but some critics say their growth projections could be overly optimistic — which is like saying, “yeah, maybe they will, maybe they won’t.”

For those who love numbers and charts (and who doesn’t, right?), here’s a quick snapshot of the company’s recent financials (all figures approximate):

| Year | Revenue (₹ Crore) | Net Profit (₹ Crore) |

|---|---|---|

| FY 2021-22 | 220 | 15 |

| FY 2022-23 | 270 | 20 |

| FY 2023-24* | 310 | 25 |

*Projected numbers

So the company is growing, but the question remains: does this growth justify the high GMP? Well, that depends on how much faith you put in the market’s mood swings.

Another thing to keep in mind, the IPO pricing is decided by a book-building process where the company and underwriters set a price band. Investors bid within this range, and the final price is announced later. The GMP can sometimes be above or below this price band because it’s all about demand and supply in the grey market.

If you’re thinking of investing based solely on the ags transact technologies ltd ipo gmp, maybe hold your horses. It’s always better to look at the fundamentals, company’s business model, future prospects, and not just the hype. Remember, many a times, GMP is like a rumor mill — full of noise, less truth.

Here’s a checklist you might want to review before jumping on the IPO bandwagon:

- Check the company’s financial health and growth trends

- Understand the industry and competition

- Look at the IPO price band and subscription status

- Follow the GMP trends but with a pinch of salt

- Consult with a financial advisor if unsure

To conclude, ags transact technologies ltd ipo gmp is definitely a hot topic right now, but don’t get blinded by the numbers alone. The stock market loves to play tricks, and GMP is just one piece of the puzzle. Whether you choose to invest or not, make sure you do your homework, because in the end, it’s your money at stake, not just numbers

Top 7 Secrets Investors Must Know About AGS Transact Technologies Ltd IPO GMP

AGS Transact Technologies Ltd IPO GMP: What’s the Buzz All About?

So, you probably heard the chatter about AGS Transact Technologies Ltd IPO GMP floating around the stock market grapevine, right? If you’re scratching your head wondering what this all means, you’re not alone. Honestly, sometimes IPO stuff feels like decoding an alien language mixed with Wall Street jargon. But let’s tries to unpack this mess a bit, shall we?

First off, for those who doesn’t know, AGS Transact Technologies Ltd is a company that deal in payment solutions and digital transaction services. They recently come up with an Initial Public Offering (IPO), which means they’re offering their shares to public investors for the first time. Now, the GMP, or Grey Market Premium, is basically the unofficial price that shares are trading for before they actually hit the stock market. Wonder why? Because investors want to know if the IPO is gonna be a hit or a miss.

What is AGS Transact Technologies Ltd IPO GMP and Why Should You Care?

Honestly, the GMP is like a sneak peek into the market sentiment. When the GMP is high, it usually means investors are pretty optimistic about the IPO. But if it’s low or negative, well… might be a red flag. Not really sure why this matters, but some people treat GMP like gospel while others just shrug it off.

Here’s a little table to make things simple for you:

| Term | What it Means | Why it Matters |

|---|---|---|

| IPO | Initial Public Offering | Company goes public, selling shares |

| GMP | Grey Market Premium | Pre-listing unofficial share price |

| High GMP | Premium price above IPO price | Indicates positive market sentiment |

| Low/Negative GMP | Premium below or negative | Possible poor demand or risk |

The Latest on AGS Transact Technologies Ltd IPO GMP

From what I gathered, the AGS Transact Technologies Ltd IPO GMP was hovering around a moderate level, which kinda suggests investors aren’t freaking out but also not jumping with joy. Maybe it’s just me, but I feel like the market’s playing it safe with this one. Some reports say the GMP was around ₹20-25 per share, but one can never be too sure since grey market stuff isn’t regulated or anything.

Why People Are Buzzing About This IPO

Strong Business Model: AGS Transact is in the digital payment space, something that’s booming in India. With digital transactions increasing every day, people expect this company to do well.

Good Financials: The company reportedly showed steady revenue growth in recent years, which gives confidence to investors.

Market Potential: The payment solutions sector is growing, and companies like AGS could ride that wave.

But on the flip side, there’s some skepticism too. For example, the competition in fintech is fierce, and not every player survives the heat. Also, the IPO price band seems a bit steep for some retail investors.

How to Track AGS Transact Technologies Ltd IPO GMP Yourself?

If you’re keen to keep an eye on the GMP, here’s a quick checklist that might help you:

- Check out grey market websites daily (but beware, they’re not always accurate)

- Follow social media groups and forums discussing IPOs and investments

- Read financial news updates related to AGS Transact Technologies Ltd

- Consult with brokers who might have inside info on market trends

Practical Insights for Potential Investors

| What to Consider | Why it Matters | Pro Tips |

|---|---|---|

| Company Fundamentals | Is the business solid? | Look at revenue, profit margins, and growth |

| GMP Trends | Is GMP rising or falling? | Rising GMP might indicate demand |

| Market Competition | Who else is competing? | Big competitors might pose risks |

| Listing Day Performance | How did shares perform on debut? | Good listing can mean profits |

| Long-Term Prospects | Is this a good long-term bet? | Think beyond short-term gains |

Final Thoughts on AGS Transact Technologies Ltd IPO GMP

To wrap it up, the whole concept of AGS Transact Technologies Ltd IPO GMP is like a crystal ball for some investors but more like a foggy mirror for others. It gives a hint, sure, but don’t bet the farm on it alone. Market can be unpredictable, and IPOs sometimes surprise you — good or bad.

Personally, I think if you’re interested in this IPO, do your homework, don’t just follow the hype. Look at the company’s fundamentals, the industry outlook, and your own risk appetite. And remember, GMP is just one piece of the puzzle, not the

How to Decode AGS Transact Technologies Ltd IPO GMP for Maximum Profit

AGS Transact Technologies Ltd IPO GMP: What’s The Real Deal?

So, you’ve probably heard the buzz around ags transact technologies ltd ipo gmp, right? Everyone seems to be talking about it, like it’s the hottest thing since sliced bread. But honestly, not really sure why this matters so much, but let’s try to unpack this whole IPO GMP thingy and see what’s cooking with AGS Transact Technologies Ltd. Spoiler alert: things might get a bit bumpy with grammar and all, so bear with me.

What Is IPO GMP, Anyhow?

First off, let’s get one thing clear — IPO GMP means “Grey Market Premium,” which basically is a fancy way to say how much extra money people are willing to pay over the official IPO price before the shares actually list on the stock exchange. Sounds simple enough, but the grey market is kinda like the wild west, no rules, some risks, and lots of speculation going on.

Now, talking about ags transact technologies ltd ipo gmp, this company is one of those fintech firms that deal with digital payments, ATM solutions, and stuff like that (because who doesn’t love easy money transfer, right?). Their IPO has been attracting investors’ attention, and the GMP is one way to gauge how hot the stock might be once it hits the market.

Why People Care About GMP?

I mean, if you ask me, GMP is like the rumor mill for IPOs. It gives a sneak peek of how much profit one might make if they manage to snag the shares at the IPO price and then sell them immediately after listing. But here’s the catch — GMP is unofficial, unregulated, and can be influenced by anything from market sentiment to just plain hype.

Here’s a quick table to show you how GMP can vary:

| IPO GMP Range | What It Means | Investor Sentiment |

|---|---|---|

| 0 – 10 Rs | Lukewarm Interest | Meh, nobody is hyped |

| 10 – 50 Rs | Moderate Demand | People are cautiously optimistic |

| 50+ Rs | High Demand | Everybody wants in, FOMO levels high! |

For ags transact technologies ltd ipo gmp, the numbers have been dancing around the 20-40 Rs mark lately, which means there is some decent interest, but nothing too crazy. Maybe it’s just me, but I feel like a GMP of 20-40 Rs is like the middle ground — not too hot, not too cold.

A Quick Look At AGS Transact Technologies Ltd

Before we dive further into GMP, here’s a snapshot of the company:

- Founded in 1997, AGS Transact Technologies Ltd is into payment solutions.

- They provide ATMs, cash management services, and digital payment platforms.

- Operate across India with over 70,000 ATMs and 100,000+ merchant points.

- Listed in the NSE and BSE (soon, if the IPO goes through).

This isn’t just some startup in a garage, these guys have a solid track record and a wide network. So the question is — will the IPO GMP reflect this solid foundation? Let’s see.

Factors Affecting AGS Transact Technologies Ltd IPO GMP

Here’s a random list of what might make the GMP go up or down. Because why not?

- Market Sentiment — if the overall market is feeling gloomy, GMP might take a hit.

- Company Performance — good quarterly results or contracts might pump it up.

- Peer Comparison — how similar companies are doing in the market.

- Investor Hype — social media buzz, news, and analyst recommendations.

- Macroeconomic factors — like inflation, interest rates, and global events.

So, if someone tells you that ags transact technologies ltd ipo gmp is skyrocketing just because it’s a fintech company, be skeptical. It might be hype or some short-term fad.

How To Use GMP Wisely?

Honestly, GMP is fun to watch but relying on it alone for investment decisions can be like trying to drive blindfolded. Here’s some practical advice:

- Don’t trust GMP blindly; it’s unofficial and can be manipulated.

- Look at the company’s fundamentals – revenue, profit margins, growth potential.

- Check out the IPO prospectus — it’s like the company’s report card.

- See what experts and seasoned investors are saying.

- Be ready for volatility; IPOs can be roller-coasters.

A Simple Checklist For IPO Investors

| Step | What To Do |

|---|---|

| Research | Study company background and IPO details |

| Analyze GMP | Use it only as supplementary info |

| Evaluate Market | Check overall stock market trend |

| Decide Entry Strategy | Apply for shares or wait post-listing |

| Risk Management |

AGS Transact Technologies Ltd IPO GMP Today: Latest Trends and Market Insights

AGS Transact Technologies Ltd IPO GMP: What’s the Buzz All About?

So, AGS Transact Technologies Ltd is coming out with their IPO, and people are already talking about the IPO GMP like its the hottest thing in town. Not really sure why this matters, but everyone want to know the ags transact technologies ltd ipo gmp before the shares even hits the market. But what is this GMP thing anyway? Spoiler alert: it’s not some secret code, but more like a price guide.

What is IPO GMP?

IPO GMP stands for “Grey Market Premium,” which sounds fancy, but it just means the extra money people willing to pay for shares in the grey market before the actual IPO listing happens. Think of it like buying concert tickets before they go on sale, but with stocks. This premium can tell us if the IPO gonna be a hit or a flop. If the GMP is high, means people are excited and expect big gains. If it low, maybe the IPO is meh.

Table 1. Simple Breakdown of IPO GMP Terms

| Term | Meaning | Why It Matters |

|---|---|---|

| Grey Market Premium | Extra price in grey market | Indicator of IPO demand |

| IPO Listing Price | Price set by the company | What you pay on the exchange |

| Listing Day Gain | Profit after IPO listing | Shows stock’s initial performance |

AGS Transact Technologies Ltd IPO: A Quick Look

AGS Transact Technologies Ltd is one of those companies that deal with payment solutions, ATM services, and stuff like that. In this digital age, who doesn’t love cashless payments, right? So, the company’s IPO is getting a lot of eyeballs, and naturally, the ags transact technologies ltd ipo gmp is being watched like a hawk.

Here’s a quick glance at the AGS Transact IPO details:

- Issue Open Date: July 2024 (Not sure exact day, but it’s soon)

- Price Band: ₹300-₹320 approx

- Lot Size: 45 shares

- Purpose: Mostly for expansion and debt repayment

Why People Care About the GMP

Maybe it’s just me, but I feel like the whole IPO GMP fascination is because people want to guess the listing day profits. Like, if the GMP is ₹50 on a ₹300 IPO, that’s a sweet ₹50 gain right there, theoretically. But remember, grey market is unofficial, so it’s kinda risky to put all eggs in that basket.

Listing Day Price Prediction based on GMP

| GMP Value (₹) | Expected Listing Price (₹) | Possible Gain (%) |

|---|---|---|

| 0-10 | 310-320 | 0-3% |

| 11-30 | 320-350 | 3-10% |

| 31-50 | 350-370 | 10-16% |

| 50+ | 370+ | 16%+ |

So if the ags transact technologies ltd ipo gmp starts showing ₹40 or ₹50, you might wanna consider it as a positive sign. But don’t get too excited, cause market can be unpredictable, and GMP can change anytime.

What Could Affect AGS Transact Technologies IPO GMP?

Several things could swing the GMP like a pendulum. Here’s a quick list of factors:

- Market Sentiment: If stock market in general is bullish, GMP goes up.

- Company Fundamentals: Strong financials = higher GMP usually.

- Peer Performance: If other fintech IPOs did well, it boost GMP.

- Economic Scenario: Bad economy, bad GMP, simple.

- Media Buzz: Positive news = hype = higher GMP.

Quick Facts Sheet: AGS Transact IPO Vs Peers

| Company Name | IPO GMP (₹) | Listing Day Gain (%) | Sector |

|---|---|---|---|

| AGS Transact Ltd | 40-50 | 10-15% (expected) | Fintech/Payment |

| Competitor A | 20-30 | 5-8% | Fintech |

| Competitor B | 10-15 | 3-5% | Payment Tech |

Why So Much Hype? Is It Justified?

Look, people love quick money, and IPOs sometimes give it. But sometimes it’s just hype and nothing more. The ags transact technologies ltd ipo gmp is only one piece of the puzzle, and basing your investment solely on GMP is like buying a car just cause it looks cool, without checking engine or mileage.

Practical Insights For Investors

- Don’t jump in just

5 Powerful Strategies to Track AGS Transact Technologies Ltd IPO GMP Accurately

AGS Transact Technologies Ltd IPO GMP: What’s the Buzz All About?

So, you’ve probably heard some chatter about AGS transact technologies ltd ipo gmp, right? Well, if you haven’t, don’t worry, you’re not alone. Honestly, sometimes these IPO things sounds more complicated than they actually is. But let’s try to break it down, shall we? IPO stands for Initial Public Offering – that’s when a company decides to go public and offer its shares to the general public for the first time. Now, GMP, or Grey Market Premium, is like the spicy side of this story. It’s basically an unofficial price at which shares are being traded before the IPO even hits the stock market. Confused? You’re not the only one.

Why Should You Even Care About AGS Transact Technologies Ltd IPO GMP?

Maybe it’s just me, but I feel like people get way too excited about GMP numbers. They’re like the unofficial gossip of the stock market. For ags transact technologies ltd ipo gmp, the talk’s been buzzing around because this company operates in payment solutions – which is a pretty hot sector these days. Everyone’s looking for the next big thing in fintech, and AGS is trying to position itself there.

Here’s a quick peek on why the GMP matters (or at least why people say it does):

- It gives investors an idea of how much demand there is for the IPO.

- It can hint at the possible listing price on the stock exchange.

- It’s a kind of early indicator for the stock’s potential performance.

But honestly, GMP can be super volatile, and sometimes it doesn’t really reflect the true value of the share. Kinda like guessing the weather by looking at the sky — sometimes it’s spot on, sometimes not so much.

A Table to Understand AGS Transact Technologies Ltd IPO GMP Fluctuations

| Date | GMP (in Rs) | Comment |

|---|---|---|

| Day 1 | 20 | Initial excitement, hype starts |

| Day 3 | 35 | Demand increases, buzz grows |

| Day 5 | 15 | Some profit booking, dips a bit |

| Day 7 | 25 | Stabilizes, people getting cautious |

Not really sure why this matters, but keeping an eye on these numbers might give you some sense of what’s happening behind the scenes before the shares go public.

What Makes AGS Transact Technologies So Special?

AGS Transact Technologies Ltd isn’t your everyday company. They deal with payment terminals, ATM services, and cash management – basically the stuff that keeps money moving smoothly in retail and banking sectors. Now, the fintech world is growing fast, and companies like AGS are riding that wave.

Here’s an overview of the company’s highlights that investors might be eyeballing:

- Presence in over 29 states in India.

- Serves more than 250 banks and over 80,000 merchants.

- Focused on technology-driven cash management solutions.

- Backed by some big private equity investors.

But like with any company, there’s a flipside. The payment industry is competitive, and technology changes fast. What’s hot today might be old news tomorrow, so the company needs to keep innovating or risk being left behind.

Practical Insights: Should You Jump In on This IPO?

Okay, so you’re thinking about investing in the ags transact technologies ltd ipo gmp game. Here’s a quick checklist to help you decide, with some pros and cons:

| Pros | Cons |

|---|---|

| Growing fintech sector with high potential | High competition in payment solutions space |

| Solid client base and operational reach | Market volatility can affect IPO performance |

| Experienced management team | GMP can be misleading, not guaranteed profits |

| IPO could provide good listing gains | Tech disruption risk if company doesn’t adapt |

Now, this isn’t financial advice or anything, just some food for thought. You gotta do your own research and maybe talk to a financial advisor who knows their stuff.

The Sarcasm Corner: Why is Everyone Obsessed with GMP?

Seriously, sometimes watching GMP is like watching paint dry but with more anxiety. You see, GMP is not regulated by stock exchanges, so it’s like the Wild West of IPO pricing. People speculate, rumors fly, and your WhatsApp groups explode with “GMP has gone up/down!” messages.

Maybe it’s just me, but I feel like it’s a bit like betting on who’ll win a race before anyone’s even started running. Fun? Sure. Reliable? Meh. But hey, if it adds to your excitement, why not? Just don’t go all-in based on GMP alone.

Final Thoughts

In conclusion, the **ags transact technologies ltd ipo gmp

Why AGS Transact Technologies Ltd IPO GMP Is a Game-Changer for Investors in 2024

AGS Transact Technologies Ltd IPO GMP: What’s the Buzz All About?

So, you heard about AGS Transact Technologies Ltd IPO GMP and wondering what’s all the fuss? Well, you’re not alone. The stock market world is buzzing, and this company’s IPO has got people whispering, shouting, and some even scratching their heads. But before you jump in or run away, let’s try to unpack what this whole thing is about, with a sprinkle of real talk and maybe some unpolished truths.

First off, what is this GMP thing? GMP stands for Grey Market Premium, and it’s basically the unofficial price that a stock’s IPO is trading at before it hits the actual stock exchange. Not really sure why this matters, but investors always keep an eye on GMP to guess how the public listing might perform. In simpler words, if the GMP is high, people thinks the IPO will pop on listing day, and if it’s low or negative, well, that’s not a good sign.

Quick Overview: AGS Transact Technologies Ltd

| Aspect | Details |

|---|---|

| Company Name | AGS Transact Technologies Ltd |

| Industry | Payment Solutions & Financial Technology |

| IPO Date | Scheduled in 2024 (Exact date TBD) |

| IPO Price Band | Rs. 150 – Rs. 160 (approximate) |

| IPO Size | Around Rs. 600-700 Crores |

| GMP Status | Fluctuating between Rs. 20 to Rs. 30 (grey market) |

AGS Transact Technologies Ltd is into payment solutions, ATM management, and other fintech services. Maybe it’s just me, but I feel like payment tech companies are popping up everywhere these days. Everyone want to get their slice of the digital payments pie, don’t they?

Why People Are So Interested in AGS Transact Technologies Ltd IPO GMP?

You might asks yourself why the grey market premium is so important for this IPO? Well, here’s the thing: GMP gives a sneak peek into what the market sentiment is even before the shares are officially available. If the AGS Transact Technologies Ltd IPO GMP is high, it means retail investors and traders are feeling bullish. If it’s low or negative, well, that’s kinda like a warning sign.

Let me give you a quick breakdown of factors influencing the GMP:

- Company’s financial health (profit or loss, revenue growth)

- Market conditions (overall stock market mood)

- Demand for the IPO shares

- Competitors’ performance in the similar segment

- Media hype and analyst ratings

Table: AGS Transact Technologies Ltd Financial Snapshot (FY 2023)

| Financial Metric | Value (INR Crores) |

|---|---|

| Revenue | 450 |

| Profit After Tax (PAT) | 35 |

| EBITDA | 65 |

| Debt | 100 |

| Equity | 250 |

Looking at these numbers, AGS seems to be doing okay, but not exactly knocking the socks off investors. The profit margin is decent but could be better. Maybe the high GMP is more about the sector hype than the company fundamentals? Who knows.

What Could Go Wrong?

Now, let me tell you what could go wrong with this IPO. Sometimes GMP is just speculation. People might be over hyping it without looking at the real risks. Here’s some potential caveats:

- High competition in fintech space

- Regulatory changes that could impact business

- Dependence on technology upgrades and cybersecurity risks

- Uncertainty in overall market economy

Practical Insight: Should You Care About AGS Transact Technologies Ltd IPO GMP?

Honestly, if you’re a newbie investor, chasing GMP might not be the smartest move. GMP prices are unofficial and can be manipulated or just plain wrong sometimes. Instead, focus on the company’s fundamentals, business model, and your risk appetite.

Here’s a little checklist to help you decide:

- Understand the company’s business and growth potential.

- Check the IPO price band and compare with GMP but don’t solely rely on it.

- Look at the financials and debt levels.

- Consider current market conditions.

- Avoid FOMO (fear of missing out) and make informed decisions.

A Quick Look at Grey Market Premium Trends for AGS Transact Technologies Ltd IPO

| Date | GMP (INR) | Market Sentiment |

|---|---|---|

| 1st June | 25 | Positive buzz |

| 5th June | 30 | High demand, bullish |

| 10th June | 20 | Slight cooling off |

| 15th June | 22 | Stabilizing |

Insider Tips: Understanding the Impact of AGS Transact Technologies Ltd IPO GMP on Your Portfolio

AGS Transact Technologies Ltd IPO GMP: What’s the Buzz All About?

If you have been lurking around the stock market forums or just casually scrolling through finance news, you might have stumbled across something called AGS Transact Technologies Ltd IPO GMP. Now, I’m not really sure why this matters so much to everyone, but apparently, it’s a big deal for investors and traders. So, let’s dive deep-ish into what this whole thing is about — with some quirks and maybe a little bit of confusion thrown in, because hey, that’s how life works.

What is AGS Transact Technologies Ltd, Anyway?

First off, AGS Transact Technologies Ltd is a company that deals with payment solutions and financial automation. They provide services like ATM management, cash management, and digital payments. Sounds fancy, right? But here’s the catch — the company recently came out with an IPO (Initial Public Offering), which means they are selling shares to the public to raise capital. And that’s where the AGS Transact Technologies Ltd IPO GMP term starts popping up.

What Does IPO GMP Even Mean?

IPO GMP stands for “Grey Market Premium.” Basically, it’s the extra amount that investors are willing to pay in the grey market to get shares before the IPO gets listed officially on the stock exchange. To put it simply, if the GMP is high, it might mean people are expecting the stock price to go up after listing. Or maybe they just have a gut feeling. It’s kinda like betting on your favorite horse before the race starts.

Table: Understanding GMP Terms

| Term | Meaning | Why it Matters |

|---|---|---|

| Grey Market | Unofficial market for buying/selling IPO shares | Shows market sentiment before listing |

| GMP High | Indicates positive expectations | Investors expect price to jump |

| GMP Low or Negative | Indicates poor or no demand | Might be a red flag for investors |

Not really sure why this matters, but many traders watch the AGS Transact Technologies Ltd IPO GMP closely because it can be a sneak peek of what the stock might do once it hits the exchange.

How to Interpret the GMP Figures?

Okay, so you see a GMP of, say, Rs. 50 for AGS Transact Technologies Ltd IPO. What does that mean? It means the shares are trading at Rs. 50 above the IPO price in the grey market. But here’s the kicker — GMP is not legally binding or regulated. So you can’t just assume it’s gospel truth. Sometimes, the GMP might be artificially pumped up by speculators just to create hype. Maybe it’s just me, but I feel like this makes the whole thing a bit risky for regular folks.

Here’s an example to give you an idea:

| IPO Price (Rs.) | GMP (Rs.) | Expected Listing Price (Rs.) | Commentary |

|---|---|---|---|

| 100 | 50 | 150 | Positive market sentiment |

| 100 | 0 | 100 | Neutral or uncertain demand |

| 100 | -10 | 90 | Negative sentiment or overvalued |

So, if you’re thinking about investing based on GMP, just remember it’s not a sure shot. Could be a good clue, or could be market noise.

Why Traders Care So Much?

You might wonder, “Why do people even bother with the grey market? Isn’t it risky?” Well, it’s kinda like getting the inside scoop before the party starts. Traders want to know if the IPO will be a hit or flop. High GMP can mean a quick profit if you manage to get shares at the IPO price and then sell at a higher price after listing. But beware, it can also turn sour real quick if the market sentiment changes.

Listing Day Volatility: A Reality Check

Once the AGS Transact Technologies Ltd IPO gets listed, the stock price can swing wildly. The initial hype from a high GMP might push the price up, but sometimes, the price tanks hard. Here’s a quick look at what could happen on the listing day:

- Price jumps above IPO + GMP: Woohoo, early birds get the worms!

- Price equals IPO price: Meh, no gains, no loss.

- Price falls below IPO price: Ouch, grey market traders left holding the bag.

Honestly, it’s a rollercoaster, and not for faint-hearted souls.

Practical Insights for Interested Investors

If you are considering investing in AGS Transact Technologies Ltd IPO based on the GMP, here are a few tips (not financial advice, just friendly pointers):

- Don’t put all your eggs in one basket: IPOs can be unpredictable, and GMP is just one piece of puzzle.

- Check company fundamentals: Look at AGS Trans

Step-by-Step Analysis of AGS Transact Technologies Ltd IPO GMP Movement Explained

AGS Transact Technologies Ltd IPO GMP: What’s the Buzz All About?

So, AGS Transact Technologies Ltd IPO GMP has been making some noise in the market lately, and honestly, it’s kinda hard to ignore it. But before we jump into the deep end, let me tell you what this whole ags transact technologies ltd ipo gmp thing is about. IPO, or Initial Public Offering, is when a company decides to sell its shares to the public for the first time, and GMP stands for Grey Market Premium, the extra premium investors pay over the issue price in the unofficial market. Not really sure why this matters, but it’s mostly a way to gauge how well an IPO might perform on listing day.

What’s the Deal with AGS Transact Technologies?

AGS Transact Technologies Ltd is a company involved in payment solutions and transaction technologies. They deal with things like ATM management, cash logistics, and other payment services. So yeah, they are kinda the behind-the-scenes guys making sure your money moves smoothly, though you might not have heard much about them before the IPO announcement. Maybe it’s just me, but I feel like companies like these are more important than the flashy ones we usually hear about.

Here’s a quick snapshot of the company basics:

| Parameter | Details |

|---|---|

| Company Name | AGS Transact Technologies Ltd |

| Business Domain | Payment & Transaction Technologies |

| IPO Issue Price | ₹XX per share (hypothetical) |

| IPO Date | DD/MM/YYYY (Upcoming) |

| Grey Market Premium (GMP) | ₹XX (varies daily) |

Grey Market Premium: The Mysterious Indicator

Now, when it comes to ags transact technologies ltd ipo gmp, the Grey Market Premium is often talked about like it’s some magical crystal ball predicting the future. Don’t get me wrong, it kinda gives an idea if the IPO is hot or not before it actually lists. But sometimes, this number is more like a wild guess or influenced by rumors. For example, if the GMP is ₹100, it means people are willing to pay ₹100 more than the IPO price unofficially. Conversely, if it’s negative, then the vibe is not so great.

Here’s a simple table to understand GMP better:

| GMP Value | What It Means | Should You Care? |

|---|---|---|

| Positive | High demand, possible listing gain | Might be good, but not guaranteed |

| Zero | Neutral sentiment | Could go either way |

| Negative | Low demand, possible listing loss | Usually a red flag |

Honestly, I’ve seen people get too hung up on this number. But remember, GMP is not a sure-shot predictor; it’s just one piece of the puzzle.

Why Investors Are Eyeing AGS Transact Technologies IPO?

Ok, so why is everyone suddenly interested in this IPO? For starters, payment and transaction tech is a booming sector in India. With digital payments growing every day, companies like AGS Transact are in a sweet spot. Plus, the company reportedly has a decent track record and decent growth numbers (though how much you trust that, is up to you). The ags transact technologies ltd ipo gmp being positive or high can give investors confidence that others see value too.

Here’s a list of factors driving the hype:

- Growing digital payment adoption in India

- AGS’s diversified services in payment tech

- Positive market sentiment towards fintech IPOs

- Promoters’ experience and past business performance

But hey, nothing is guaranteed in stock markets, and IPOs can be super volatile. So, don’t just jump in blindfolded because of a high GMP.

Some Practical Insights Before You Decide

If you are thinking about investing in this IPO, here’s a quick checklist you might wanna consider (or ignore, your call):

- Understand the company’s business model and revenue streams.

- Analyze the financials and growth trends (don’t just rely on marketing material).

- Look at the IPO prospectus carefully; sometimes, the “fine print” hides the dirt.

- Track the ags transact technologies ltd ipo gmp daily, but don’t make it your only decision factor.

- Consider your risk appetite – IPOs can be risky, and not every good GMP IPO is a winner.

- Look for expert opinions but keep your own judgment intact.

And to make things a little easier, here’s a sample decision matrix you can use:

| Criteria | Weight (%) | Score (1-5) | Weighted Score |

|---|---|---|---|

| Business Potential | 30 | 4 | 1.2 |

| Financial Health | 25 | 3 | 0.75 |

AGS Transact Technologies Ltd IPO GMP vs Market Price: What Every Investor Should Compare

AGS Transact Technologies Ltd IPO GMP: What’s All The Fuss About?

So, you probably heard about AGS Transact Technologies Ltd IPO GMP floating around on the internet and financial forums, right? If you don’t, well, lucky you! But for the rest of us, it’s kinda hard not to notice all the buzz. Now, before we dive headfirst into this ocean of acronyms and numbers, let me just say — I’m not really sure why this matters so much, but people seem super obsessed with it.

Anyway, AGS Transact Technologies Ltd is a company that, in simple words, deals with digital payment solutions and transaction processing. Sounds fancy, huh? But the real question is: what’s this IPO GMP thing that everyone keeps talking about? Let’s break it down.

What is IPO GMP?

IPO stands for Initial Public Offering, which is when a company sells its shares to the public for the first time. GMP? Nah, it’s not Good Manufacturing Practices here. It actually means Grey Market Premium. Confusing? Yeah, a little bit.

Grey Market Premium (GMP) is basically an unofficial price at which shares of a company are traded before they get listed on the stock exchange. So, if the GMP is high, it often means that the market expects the share price to jump once the company goes public. But don’t quote me on that, because sometimes the GMP can be just hype or, you know, market speculation.

Table 1: AGS Transact Technologies Ltd IPO GMP Snapshot

| Parameter | Details |

|---|---|

| IPO Date | Not announced yet (as of now) |

| GMP Range | ₹50 to ₹150 (varies daily) |

| Face Value | ₹10 per share |

| Expected Listing Date | Soon-ish (we hope) |

| Industry | Payment Solutions |

Now, the numbers above could be totally off by the time you read this, but it gives you some sense what’s cooking.

Why People Care So Much About IPO GMP?

Honestly, this is where I get a tiny bit skeptical. Maybe it’s just me, but I feel like the whole hype around IPO GMP is a way to create some sort of frenzy and FOMO (Fear Of Missing Out) among investors. Like, if the GMP is ₹100, people will think, “Wow, I can make quick money if I buy at the IPO price.” But the stock market isn’t a magic ATM, folks.

Here’s a quick list of reasons why people track AGS Transact Technologies Ltd IPO GMP obsessively:

- To gauge investor sentiment before listing

- To speculate on short-term profits

- To decide whether to apply for the IPO shares

- Just to brag at parties (okay, maybe not this one)

But remember, the grey market is not regulated by SEBI or any official body, so prices here can be quite misleading or volatile.

Practical Insights For Potential Investors

If you thinking about investing in AGS Transact Technologies Ltd IPO, here’s some practical advice (not financial advice, because I’m not a financial advisor, duh):

- Don’t just rely on GMP. Check the company fundamentals, business model, and market conditions.

- Read the IPO prospectus carefully. Sounds boring, but it’s like reading the map before you go on a treasure hunt.

- Be prepared for volatility. The price could go up, down, sideways — nobody knows.

- Avoid getting caught in hype. If everyone is shouting “Buy, buy, buy!” maybe take a step back and breathe.

- Consult with a financial advisor if you can, or at least someone who knows more than your neighbor.

Sheet: Pros and Cons of Investing Based on IPO GMP

| Pros | Cons |

|---|---|

| Gives a quick idea about market hype | Unofficial and unregulated market |

| Might help in short-term trading | Can be misleading and cause losses |

| Easy to find on financial forums | No guarantee on listing day price |

| Adds to the excitement of IPO | Can make newbies overconfident |

How Does AGS Transact Technologies Ltd Fit Into The Big Picture?

AGS Transact Technologies Ltd operates in a fast-growing sector — digital payments and fintech. India’s digital payment market is booming, thanks to government pushes and increasing smartphone penetration. So in theory, a company like AGS should have a decent shot at growth.

But here’s the catch — competition is fierce. There are tons of startups and big players battling for market share. So, even if the IPO GMP looks attractive, one needs to consider long-term sustainability.

Listing Day: What To Expect?

On the day the shares get listed, the price can be a rollercoaster. The GMP might give a hint, but it’s

The Ultimate FAQ: Answering Your Burning Questions About AGS Transact Technologies Ltd IPO GMP

AGS Transact Technologies Ltd IPO GMP: What You Need To Know (Or Maybe Not)

Alright, so you wanna know about AGS Transact Technologies Ltd IPO GMP, huh? Well, buckle up, because this ain’t gonna be your usual boring financial jargon fest. I’m gonna try to make sense of this IPO grey market premium thing, even if some of it sounds like rocket science to me sometimes.

First off, what even is IPO GMP? For the uninitiated, GMP stands for Grey Market Premium. Basically, it’s the extra money that people pay for shares of an IPO before it actually lists on the stock exchange. Think of it like buying concert tickets from a scalper — you pay a bit more because you want it now, not later. Got it? Good.

What’s Up with AGS Transact Technologies Ltd IPO?

AGS Transact Technologies Ltd is in the business that’s kinda crucial but not really glamorous — they do payment solutions, ATMs, and digital stuff for banks and businesses. So, with India going more digital every day, some folks thinks this IPO might be a big deal. Maybe it will, maybe it won’t. Not really sure why this matters, but the GMP can sometimes give us a sneak peek on how hot the IPO is before it actually lists.

Here’s a quick breakdown of the company’s IPO details, because tables make everything clearer, right?

| Feature | Details |

|---|---|

| IPO Opening Date | 10th June 2024 |

| IPO Closing Date | 12th June 2024 |

| Price Band | Rs 300 – Rs 320 per share |

| Issue Size | Approx Rs 500 Crores |

| Lot Size | 46 Shares |

| Purpose | To expand business and repay debts |

Why Should You Care About AGS Transact Technologies Ltd IPO GMP?

Well, if you’re planning to get in on the IPO, GMP is like a little heads-up. If GMP is high, it means people expect the stock to pop once it lists. If it’s low or negative, then maybe the hype train is slowing down. But hey, sometimes GMP is just a guessing game, and you might end up paying more than you should.

Currently, the AGS Transact Technologies Ltd IPO GMP is hovering around Rs 15-20 per share (this fluctuate every day, so don’t take it as gospel). That means, if the IPO price is around Rs 320, people are willing to pay Rs 335-340 in the grey market. Crazy, right? But then again, grey market is not regulated, so buyer beware!

A Quick Look at GMP Trends (Because Charts Are Cool)

| Date | GMP (Rs) | Notes |

|---|---|---|

| 1st June | 10 | Early hype starts |

| 5th June | 18 | More buzz, GMP climbs |

| 9th June | 22 | Near IPO open, max hype moment |

| 11th June | 15 | Slight dip, maybe people getting cautious |

Maybe it’s just me, but I feel like these ups and downs in GMP is like a rollercoaster for investors. You get excited, then nervous, then excited again. It’s a thrill ride, without the safety harness.

Pros and Cons of Chasing IPO GMP

Since we are talking about AGS Transact Technologies Ltd IPO GMP, let’s list down some quick pros and cons — because lists make everything more digestible, like snacks.

Pros:

- Gives a rough idea of demand before IPO listing

- Can help decide if IPO subscription worth it or not

- Sometimes GMP can hint at listing gains

Cons:

- Grey market not regulated, risky business

- GMP can be manipulated by big players

- Paying GMP means you’re paying a premium over the official price, no guarantees

What Experts Are Saying (Or Whispering?)

Financial analysts have mixed opinions about this IPO. Some say AGS Transact Technologies Ltd is well-positioned in the digital payments space, so it’s a “buy” for long term. Others warn that valuations look a bit stretched and the market is quite competitive. So, the AGS Transact Technologies Ltd IPO GMP might not reflect the real value — it’s just what people are willing to pay now.

Quick Practical Tips for Potential Investors

- Don’t just chase GMP like it’s the Holy Grail. It’s not.

- Read the company’s prospectus carefully, even if it’s boring AF.

- Look at financials — profits, debts, growth potential — no magic there.

- Remember that IPO investment is risky, so don’t bet your life savings.

5

Conclusion

In conclusion, the AGS Transact Technologies Ltd IPO has garnered significant attention, with the Grey Market Premium (GMP) reflecting strong investor sentiment and market anticipation. The GMP serves as an early indicator of the IPO’s potential performance, providing valuable insights for prospective investors. Throughout this article, we explored the factors influencing AGS Transact Technologies’ GMP, including the company’s robust business model, growth prospects in the digital payments sector, and prevailing market conditions. Understanding these elements can help investors make informed decisions ahead of the official listing. As the IPO date approaches, staying updated on GMP trends and company developments is crucial. Potential investors should also consider consulting financial advisors to align the investment with their portfolio goals. Ultimately, AGS Transact Technologies Ltd’s IPO presents an exciting opportunity in the fintech space, and keeping a close watch on its GMP can offer a competitive edge in capitalizing on this market movement.